Whether you’re a digital nomad, an expat living abroad, or a foreign worker living and working abroad, you must have a back up plan. That’s where nomad travel insurance comes in; as a golden Plan B to the travel and medical insurance you may already have in your home country.

Over the years I’ve learned that being prepared for the worst with long term travel insurance (as a travel blogger) is the best way to make sure a trip doesn’t end early because of a sticky situation.

Most digital nomads have heard about travel insurance, but I’ve discovered a company that creates travel and medical insurance, tailored specifically to digital nomads around the globe.

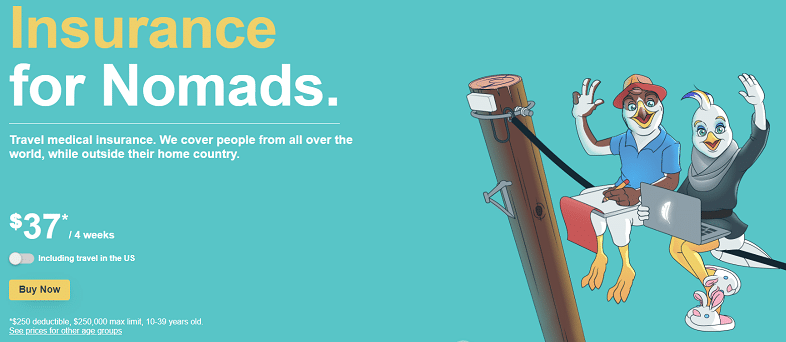

Say hello to Safetywing Insurance

Adventure Girls Need Nomad Travel Insurance

I’ve said it once and I’ll say it again: be prepared! Don’t let a travel disaster ruin your nomad travels. Get travel insurance that has your back.

As a seasoned traveling adventuress, I’ve had my fair share of voyages; both which have been perfect and umm…complete disasters. I’ve lost luggage. I’ve missed flights. I’ve even been sick in a Russian hospital, in the middle of nowhere for 2 weeks with a bunch of Grandmas after crossing The Mongol Rally finish line.

Why should I buy travel insurance?

I get it. A wary backpacking traveller may pass up travel insurance. It can be:

- Expensive

- Complicated to set up

- Unavailable when you’re already on the road

But SafetyWing are great

- Insurance costs as little as $37 a month (1/3 cost of World Nomads)

- Monthly subscription model (cancel whenever you want!)

- Maximum limit of $250,000 (that’s a lot!)

- Setup online is super quick and easy

- Insurance can be bought at home or on the road – at any point in your trip!

- Worldwide coverage excluding North Korea and Iran

Don’t be the traveller who has to return home with lost items and ill health. You’re a kickass nomad that doesn’t have time for set backs like lost luggage, breaking a leg and not having the money to fix it. You need the best trip insurance out there for the awesome explorer that you are!

SAFETYWING QUICK ANSWERS

SafetyWing offer a monthly medical and travel insurance plan starting from $37 per month.

Awesome things that SafetyWing insurance for travel nomads includes:

- Coverage for travel delays or trip interruptions ($5000)

- Lost checked luggage ($3000 at $500 per item)

- Terrorism ($50,000)

- Emergency medical evacuation ($100,000)

- Emergency medical expenses (no limit)

- Emergency room visit (no limit)

- Urgent care (no limit)

- Emergency dental coverage ($1000 limit)

- Acute onset of pre-existing condition (no limit)

- Personal liability ($10,000)

GET A SAFETYWING NOMAD TRAVEL INSURANCE QUOTE HERE

SafetyWing provide medical and travel insurance

Digital nomads need to not only cover travel mishaps, but also protect their health at the same time. This is why SafetyWing offer the ultimate combo for adventurers who are working and travelling on the road: medical and travel insurance.

Medical Insurance

One of the worst things that can happen while travelling is getting ill. Even if you do budget for the occasional possible emergency abroad, as a digital nomad it is hard to ever set aside enough for a lifetime of emergency travel coverage. When in a country on a tourist visa, world nomads won’t be able to access that country’s healthcare for the price citizens pay, and unexpected emergencies abroad can quickly eat up your emergency fund and beyond.

Getting sick in a foreign country is scary enough without worrying about your bank account.

SafetyWing cover illnesses and injuries that can happen to you whilst you’re abroad out of the blue. The insurance covers emergency medical evacuation, medical expenses, emergency room visits, urgent care and even emergency dental coverage.

If you’re a solo traveller like me, buying nomad health and travel insurance won’t be the same as having someone bring you a steaming bowl of yummy soup, but SafetyWing have your back when #adulting is at its hardest.

Travel Insurance

Travel insurance is for all of those things that can happen when you least expect it whilst travelling! Travel insurance covers travel delays, lost checked luggage, emergency response, natural disasters and personal liability.

Lost luggage, a stolen handbag, or forgetting your passport on the train are all awful circumstances travellers and bloggers are desperately trying to avoid. International travel insurance protects your assets and helps you quickly replace stolen goods or a missing passport quickly. A travelling lady’s best asset is her passport, so make sure yours is protected.

SafetyWing insurance covers lost checked luggage up to $3000 with a maximum of $500 per item.

Save your bank balance in the long run

When you’re exhausted or ill, the last thing on your mind should be worrying about finances. Worldwide travel insurance makes being sick or in a sticky travel situation much better on your bank balance.

Medical bills and lost items can cost A LOT of money. By investing in travel insurance, you’ll be able to get back on the road and back to working online sooner rather than later. Boss ladies have no time for worries. Nomad travel insurance is a must have.

What is the best and most cost effective travel insurance options for long term travelers?

Having a safety net of an emergency fund is a great start, but adding a great world travel insurance policy is the surest way to stay safe and secure while adventuring.

However, it can be hard to find cheap travel insurance that has great coverage AND works for us digital nomads and adventure ladies.

With so many travel insurance companies out there, I’m always on the lookout for the best of the best. In the past, I have used World Nomads Travel Insurance to insure myself on my digital nomad travels.

But, there’s a new kid on the block…

SafetyWing: Travel Medical Insurance for Nomads by Nomads

What can SafetyWing do for me?

On my most recent trip to Pakistan, I put SafetyWing to the test – and even though I didn’t have to claim anything from them (thankfully), these are the reasons why I gave them a shot…

SafetyWing is a new global travel insurance designed specifically for nomads who frequently travel outside of their home country, but can also be a great budget travel insurance option for one-off vacations.

SafetyWing maintain great coverage with low rates, making it the most affordable travel insurance (yes, it’s cheaper than World Nomads).

If you travel frequently like me, having year long travel insurance can make nomad explorer life and business easier. And since you can enroll for a period of 364 days at a time, as many times as you’d like, SafetyWing gives nomads what many insurances can’t; the best annual travel insurance at an amazing price.

Find out more about SafetyWing here

How much is travel insurance with SafetyWing?

The cost of SafetyWing nomad insurance depends on how old you are and if you are going to be spending time in the USA. Being in the USA can almost double the price of the insurance!

You can use SafetyWing’s handy price calculator to see an estimate of your exact trip dates and details.

A two week trip in the US will only cost you around $33 (depending on age and travel dates) for complete coverage.

Excluding the USA, around a month of backpacker travel insurance coverage with SafetyWing will only cost you around $37, more than a third less than competitors.

With the low deductible of $250 and the amazingly high $250,000 maximum limit, this global nomadic plan is really hard to beat. Especially in countries like America where healthcare costs are insanely high; travel insurance could save you thousands of dollars in the case of an emergency.

Head to the SafetyWing site to start calculating

What does SafetyWing cover?

Beyond your health, a SafetyWing travel insurance plan will cover things like lost luggage, flight cancellations, and many more travel related inconveniences.

Here’s a recap from above about what SafetyWing nomad insurance covers!

SAFETYWING INSURANCE

SafetyWing offer a monthly medical and travel insurance plan starting from $37 per month.

Awesome things that SafetyWing insurance for travel nomads includes:

- Coverage for travel delays or trip interruptions ($5000)

- Lost checked luggage ($3000 at $500 per item)

- Terrorism ($50,000)

- Emergency medical evacuation ($100,000)

- Emergency medical expenses (no limit)

- Emergency room visit (no limit)

- Urgent care (no limit)

- Emergency dental coverage ($1000 limit)

- Acute onset of pre-existing condition (no limit)

- Personal liability ($10,000)

Be sure to read the helpful FAQ on their page yourself and take note of what is and isn’t covered (like pre-existing conditions and preventative care).

SafetyWing have your back in the case of cancelled flights, stranded luggage, and more. SafetyWing saves you from sleeping at the airport when your flight is cancelled or wearing the same outfit until you can scavenge some tacky tourist wear too. Not many cheap travel insurance plans can boast this!

Adventure Sport and Gym Workouts

Planning on kayaking, skiing or surfing? SafetyWing covers loads of the most popular travel related sports, so don’t be afraid to dip your toes in the water and dive in.

You may take for granted that your everyday gym activities are covered by the insurance you have at home, but if you’re a nomad taking daily yoga classes, cycling around, or lifting weights, it’s good to know that SafetyWing nomad travel insurance covers any emergencies caused by your daily workout.

Keeping Electronics Safe

When choosing travel insurance it is important to make sure you read the details of your plan coverage. If you hunt for coverage for gadgets such as laptops, cameras, drones and phones, you need to double check both the quality of the coverage and the geographic area where you’ll actually covered. Many insurance companies offering protection for your electronics are regional only.

You should note that SafetyWing *do not* currently insure your electronics like phones, laptops, and cameras if they are damaged or stolen. This is the one weakness that SafetyWing currently have in my books.

BUT…

There is a good explanation for it.

First of all; providing coverage for stolen items while on the road will significantly increase the cost of your insurance. Secondly; SafetyWing want their electronics insurance to work as well as their travel medical insurance does: equally good quality and everywhere!

SafetyWing will be adding on electronics coverage as an add-on later this year

They’re currently sorting this, so I’ll let you know when I know!

Currently, the comparable travel insurance companies that cover these items are more than triple the cost of SafetyWing however. Therefore, I’d recommend buying insurance for your electronics separately if necessary for now. It’s also worth checking out my top security devices here that I use to keep my electronics safe and sound.

Visiting Home

SafetyWing even covers you on your visits home. For every 90 days you are covered with SafetyWing nomad insurance, you are covered for 30 days in the case of medical emergencies. Make sure to read the fine print in the FAQs. If you’re an American, you are reduced to 15 days of coverage for every 90 days. But overall, this home country medical insurance coverage is pretty groundbreaking.

Extreme Circumstances

It might seem extreme, but SafetyWing cover emergency evacuation as well as kidnap and ransom cover and a few other quite dire situations.

Read: I was kidnapped whilst traveling solo in Peru

Although unlikely, sadly sometimes crazy bad weather, natural disasters, or other uncontrollable things can make your vacation end unexpectedly and leave you in a bind.

Family Coverage

Parents on the go can rest easy since SafetyWing cover children of insured parents. SafetyWing is a good family travel insurance option, as it covers one child (ages 14 days to 10 years old) per adult, up to 2 per family, without any extra fees.

When Can I Buy Travel Insurance from SafetyWing?

Anytime! If you’re a digital nomad already working in a foreign country, you can still start your coverage right away, which truly shows that SafetyWing is one of the best travel insurances for kick ass adventure travelers.

SafetyWing is definitely a good to go insurance, making it a step ahead of other travel health insurance options. We’re living in a digital age, so it makes sense to get travel insurance online from a tech savvy company.

How to Access Medical Care with SafetyWing

SafetyWing have a global database of qualified medical practitioners and make finding local emergency or urgent care treatment easy. You can easily find local care through your online account or by calling SafetyWing’s team.

Is SafetyWing the right nomad travel insurance for me?

It’s always good to compare travel insurance options when considering buying a travel insurance plan. SafetyWing works great for digital nomads and casual travellers, but if you’re an extreme athlete, you may need more extreme (and expensive) insurance.

SafetyWing can be a great option for a digital nomad on a budget, offering great emergency travel and health insurance for one of the best prices on the market.

For the price and extensive coverage tailored for nomads, SafetyWing is the best value travel insurance in my book.

If you’re uninsured and travelling, here’s my link to sign up for affordable nomad health insurance from SafetyWing. Be brave and always travel insured!

*This post is sponsored by SafetyWing: as always views and opinions remain my own = honest and straight to the point*

Comment Below

What travel and medical insurance do you use when you prepare to travel? How has your experience with SafetyWing been? Do you have any travel insurance stories you want to share? I look forward to interacting with you!

Related Reading

How to travel safely as a woman

How to physically and mentally stay fit while travelling

Wow, great in-depth coverage. Thanks for all of the info and clarifying a few things.

Do you know if they offer trip cancellation protection?

Hi Chris! Sorry, Safetywing do not currently offer trip cancellation protection.